A publication of

Summer issue 2015 sponsored by

A publication of

Summer issue 2015 sponsored by

CRE Finance World Summer 2015

51

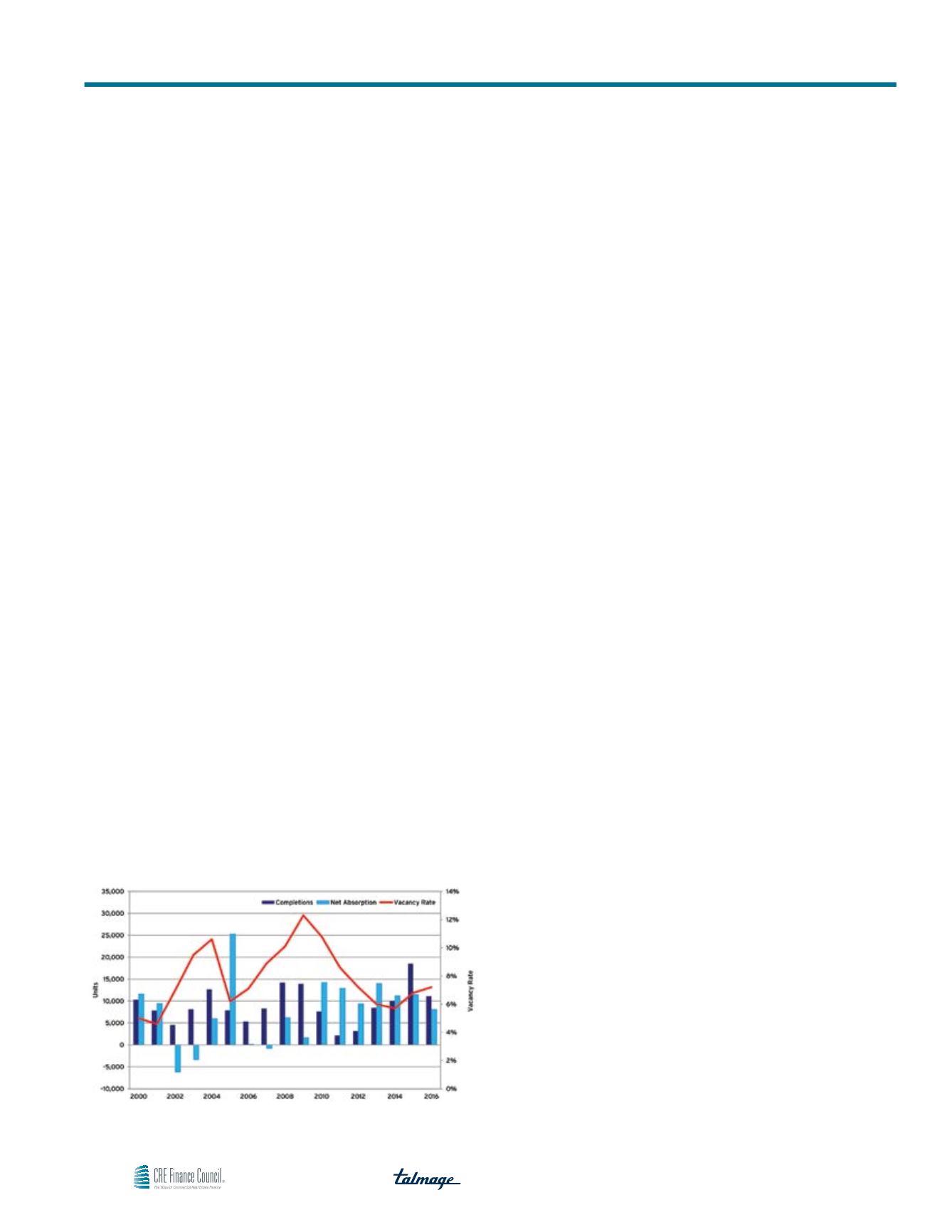

through 2019 due to new development and the maturation of the

multifamily cycle. It is for these reasons that we believe vacancy

will rise in the coming years, not because of falling energy prices.

Our preliminary first quarter results show that vacancy held steady

at 5.8% but is up 20 basis points over the past 12 months. Quarterly

rent growth was 1.0%, ranking 13th in the nation. Oil prices have

been declining for nine months but the multifamily market has

remained resilient. Household formation and population growth are

strong while employment growth has held steady despite the hit to

the energy sector. The vacancy will begin to rise, however, as more

and more new supply is completed. In 2014, 10,065 units were

completed, a 1.9% increase in inventory. Reis forecasts construction

to total more than 18,500 units in 2015, increasing inventory by

3.4%. The current vacancy rate should also be viewed in context.

The metro’s long-term average vacancy rate is roughly 9.2%.

Without counting the 1980s, a decade of extreme overbuilding in

the metro, long-term vacancy is about 7.4%. So even forgetting

the recent fall in energy prices, the combination of below-average

vacancy and a significant influx of new supply is already signaling

vacancy increases over the next several years. The fall in oil prices

will not have a serious impact on this market trajectory.

We also believe that Houston’s diverse economy, resilient job

growth and strong population growth will insulate the retail sector

from any major negative pullback from low oil prices. Preliminary

first quarter 2015 results further confirmed our outlook. Vacancy

among Houston’s neighborhood and community centers fell 30

basis points in the first quarter to 11.3%, the eighth largest decline

among Reis’ primary metros. Effective rents also grew 0.8% for the

quarter, almost on par with rent growth exhibited in the multifamily

sector. Annual rent growth is now at 3.1%, the tenth largest increase

in the country.

Exhibit 2

Houston Apartment Supply and Demand Trends

Source: Reis

Office and industrial properties in major energy metros are more

likely to be directly impacted by oil price declines and the subsequent

layoffs in the energy sector. Energy companies and supporting

professional service firms are major users of both office and

industrial space and attached to a significant number of projects in

the development pipeline. With major energy firms like Schlumberger

and Halliburton already announcing layoffs, many planned expansions

may potentially be delayed or cancelled, depressing demand for

commercial space. The key is that for more established companies,

the break-even point for oil is far lower for fracking wells ($35 to

$45 per barrel) than the new, highly-levered entrants that bought/

leased land when energy prices were far higher ($75 to $85 per

barrel). The newer, highly-leveraged firms are the ones that may go

out of business. The bigger, monolithic firms will lay some people

off, but this will mostly be confined to exploration. Still, our office and

industrial projections for Houston have been reduced to account

for the decline in demand.

The negative impact on the Houston office market was already

evident in preliminary results for the first quarter of 2015. Net

absorption was barely positive during the first quarter and was

actually negative in February and March. Meanwhile, construction

was relatively robust for the quarter, resulting in a 60 basis point

increase in vacancy since the end of 2014. This was tied for the

third largest increase in vacancy across the country. As a result

the Houston market’s vacancy rate currently sits at 15.1%, the

highest level since the third quarter of 2011. Moreover, the Federal

Reserve Bank of Dallas noted in the March release of the Beige

Book that some energy firms are seeking to sublet office space in

Houston. And unless a large portion of projects are put on hold,

there is more office space to be delivered in the near future. Over

7.5 million square feet of office space in Houston will likely be

delivered in 2015, representing 19% of all projected completions

due across the nation. In 2016, that figure falls to 16% but the

actual amount of space to be completed is even larger, on the

order of 7.7 million square feet.

For most other metros, a steep decline in oil prices will be a boon

for consumers and businesses alike (particularly in energy-intensive

industries), effectively acting as a tax break. This leads to a rise

in disposable incomes for consumers and a decline in costs for

firms. Retailers should benefit directly when more money remains

in the hands of shoppers and leads to higher sales. This process

was already underway as of late 2014; fourth quarter GDP figures

indicated personal consumption grew at its highest rate in years,

bolstered by the decline in oil prices. However, retail sales growth

has actually turned negative in early 2015. Excluding autos and

gasoline, sales were down 0.1% in January and 0.2% in February.

Much of this decline can be attributed to severe inclement weather

and below-average temperatures across a large swath of the

Low Energy Prices’ Impact Mixed, Multifamily May Be Least Pronounced