CRE Finance World Summer 2015

52

country. Year-over-year figures (excluding autos and gas) are still

in line with the latter half of 2014, indicating spending may not be

suffering like headline monthly figures suggest.

The regions of the country poised to benefit most from the decline

in oil prices are those that have underperformed since the beginning

of the recovery, namely the Northeast and Midwest. Both regions

have very little exposure to the oil industry compared to the South

and West and stand to reap the benefits of falling oil prices without

bearing the brunt of negative effects. Since energy costs are

generally higher in the Northeast and Midwest, declining oil prices

will have a greater positive effect than elsewhere. Moreover, the

reliance on industrial production in the Midwest leaves the region

susceptible to fluctuations of oil prices given their use as an input

in the manufacturing process. Auto manufacturers, stalwarts of the

Midwestern manufacturing industry, should gain two-fold from a

decline in oil prices. Input costs decrease and boost profits while

lower gasoline prices make buying a car more attractive.

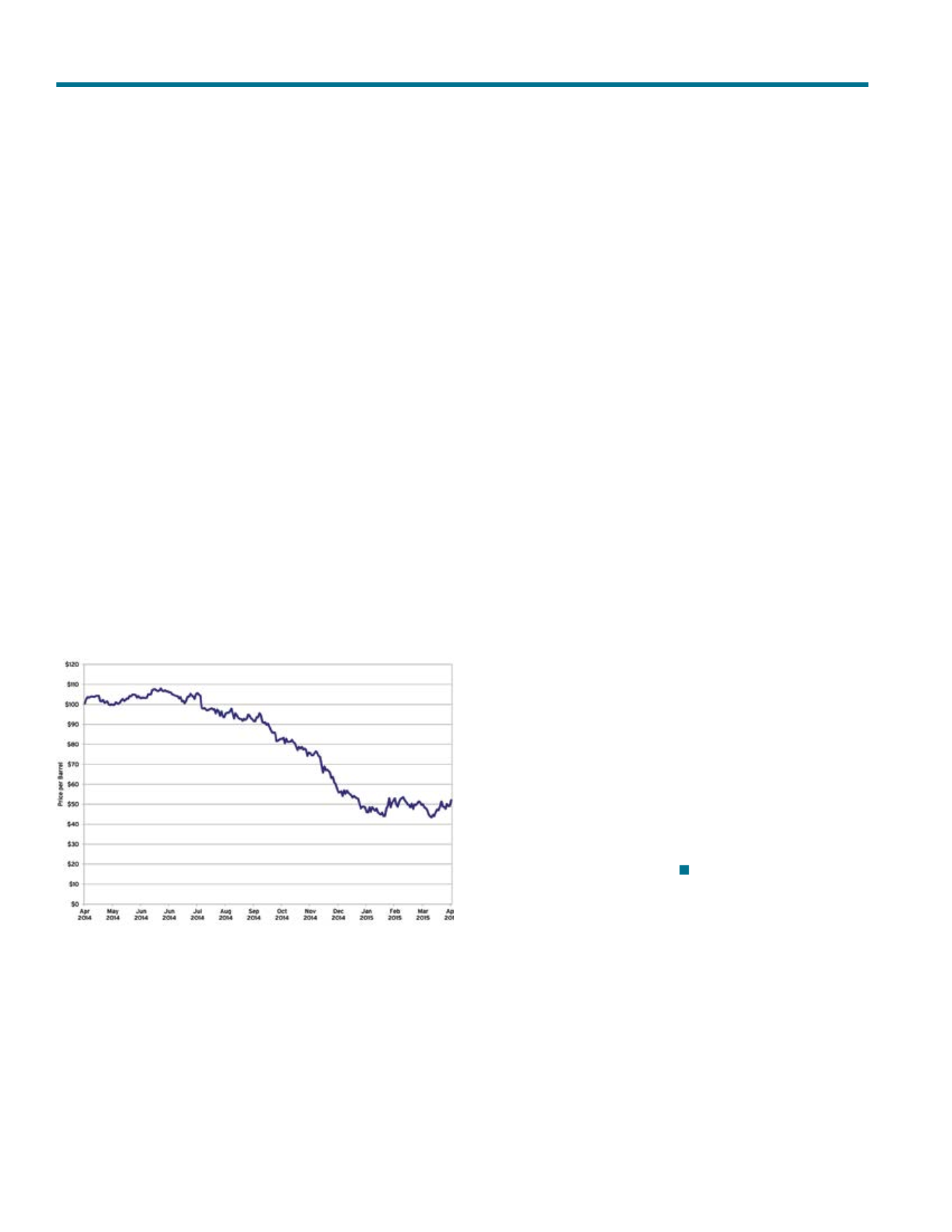

Exhibit 3

West Texas Intermediate Crude Oil — Price per Barrel

Source: Federal Reserve Bank of St. Louis

We must be careful not to overstate the effect a decline in oil

prices may have on the commercial real estate market. As we

have noted, the major energy metro, Houston, has diversified its

economic base significantly over the past couple of decades. The

demographic trends in the metro are very favorable. Also, it is not

a given that prices will remain at current depressed levels for an

extended period. We are more than 9 months into the current

downturn in oil prices. A recent analysis by the Federal Reserve

Bank of St. Louis took a look at all major episodes of oil price

declines in non-recessionary environments since 1983. They

calculated the average duration of each of these declines to be

8.6 months, a figure that was heavily influenced by a 23 month-

long episode in the late 1990s, with a median of just 6 months.

While this by no means indicates we are at the end of the current

decline, it is telling that we are already past the average duration

of such episodes and well past the median. As of the writing of

this article, the WTI spot price is in the low $50 range. At present,

most forecasts call for oil prices in the $50 per barrel range by late

2015 and into the $60 range in 2016. This is still quite low, but

remains comfortably above the $35 to $45 per barrel breakeven

point for the larger oil companies.

The consequences of lower energy prices will mostly be felt by

office and industrial properties. Any effect on the multifamily and

retail sectors will be felt indirectly, but we believe neither will suffer

any significant downward pressure on fundamentals. As such, our

forecasts in Houston for these two property types have not changed

much due to the decline in oil prices. Overall we are not saying that

real estate fundamentals will continue to improve indefinitely for

Houston multifamily: for a variety of reasons unrelated to low energy

prices, we have already been forecasting a rise in vacancies and

a moderation in rent growth over the next five years. However, to

claim that the impact of low energy prices will be substantive, or

changing our current view of the trajectory of fundamentals in a

significant way, is an overreaction.

Low Energy Prices’ Impact Mixed, Multifamily May Be Least Pronounced