CRE Finance World Summer 2015

48

Williston’s multifamily sector is expected to see further decreases

in rent and higher concession rates if the rig counts continue

declining over the next few months — a very likely scenario.

Slowdown in Midland-Odessa, Texas

Midland-Odessa has the highest concentration of oil and gas

industry jobs in the country and, as a result, has been in the midst

of an exceptional expansion for the past several years. The area’s

job market has grown by an average 6.4 percent per year since

2009 – more than four times the national average.

This has been driven by the oil economy in the region, which has

accounted for an estimated 40 percent of the 45,000 jobs created

since 2009. Yet, during this period, apartment development has

been unexpectedly muted. Since 2009, just 10 apartment projects

have come online, accounting for 2,400 units. For context, there are

an estimated 20,000 multifamily units in the Midland-Odessa area.

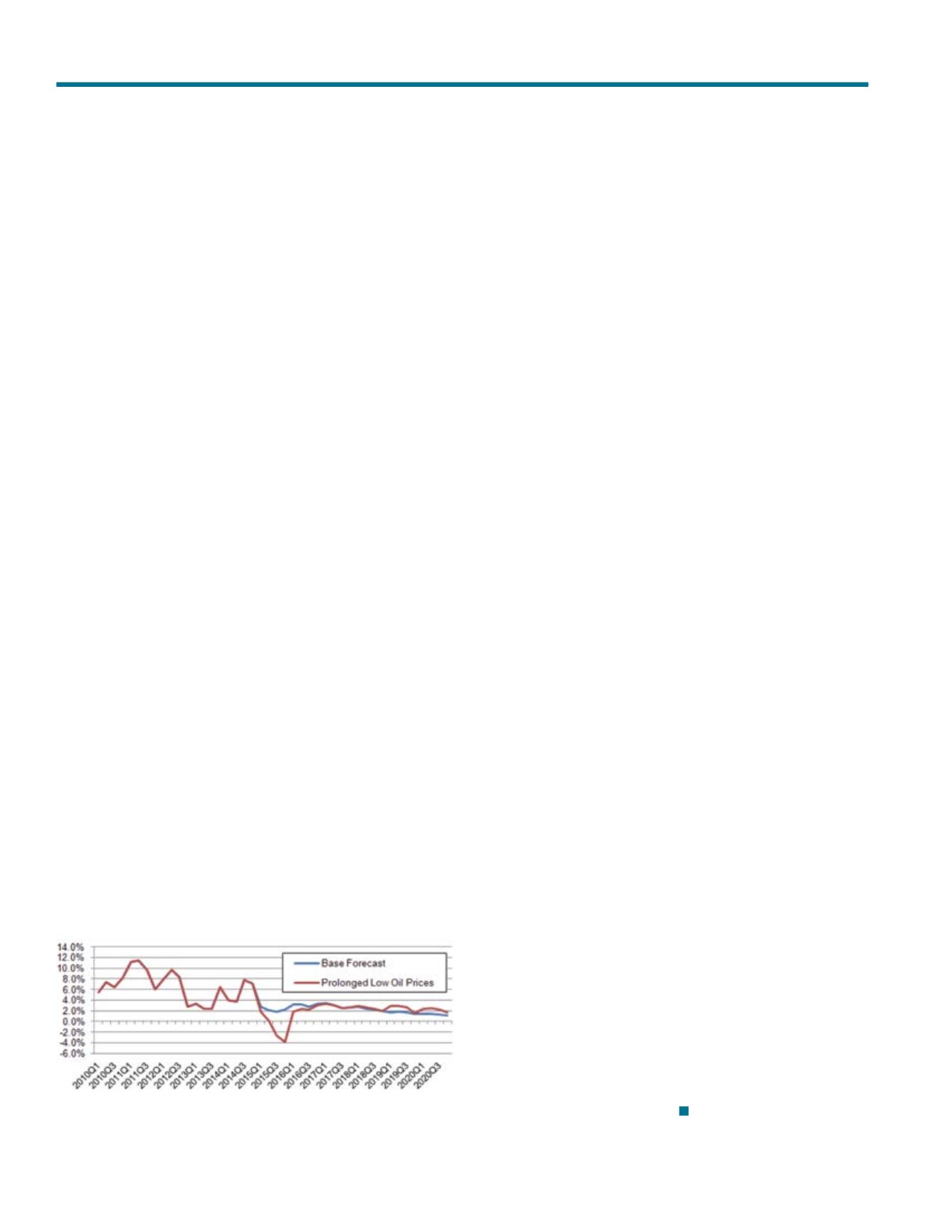

With falling oil prices, Midland-Odessa is poised for a significant

slowdown, though calamitous conditions in the job and apartment

markets are not expected. Moody’s Analytics estimates that job

growth in the area will remain positive, slowing to a still-respectable

2.2 percent this year compared to an enviable 5.6 percent in 2014,

as seen in the chart below. Moody’s Analytics provides an additional

forecast that keeps oil prices low longer than expected, and even

in that forecast Midland-Odessa’s job market is forecasted to

contract by just -1.2 percent in 2015, with job growth rebounding

to 2.4 percent in 2016.

The base forecast for Midland-Odessa’s job market results has real

estate research firm Reis, Inc., anticipating that the metro’s apartment

market will see vacancy rise to 7.0 percent by year-end 2015, up

from 6.1 percent in 2014, and rent growth remaining positive —

though slowing — to an enviable 6.8 percent for 2015, down from

7.8 percent for 2014.

Exhibit 5

Midland-Odessa Quarterly Job Growth Forecast (CAGR)

Source: Moody’s Analytics

Keeping an Eye on Some Metros

Other mid-sized metro areas that have a concentration of oil jobs

and could have some more trying times ahead include Lafayette,

Louisiana; Corpus Christi, Texas; Oklahoma City; Shreveport,

Louisiana; and Bakersfield, California. All of these metro areas

have seen oil drilling jobs enhance their local economies over the

past several years, and are poised to see that additional job growth

diminish if oil prices remain low, especially over the long-term.

From a multifamily rental sector perspective, these metros are

likely to see some softening conditions ahead but none of these

places have been hotbeds of apartment development activity, and

the impact of a slowdown in oil jobs should not obliterate local

apartment sector demand.

National Benefits and the Multifamily Sector

The rise in North American oil production and the recent drop in

worldwide oil prices should be a benefit to consumers across the

country. Greater disposable income would stimulate tourism, retail

sales, as well as a diverse set of industries, allowing the national

economy to potentially grow more than previously forecast, in turn

bolstering a generally healthy national apartment market. Indeed,

some suburban and especially exurban submarkets in most major

metros could end up seeing an improvement in overall housing

fundamentals since commuting would now be less expensive,

thanks to lower gasoline prices.

The fall in oil prices would be felt more acutely in just a few

geographical areas and in certain local jobs. Fortunately, for most

of these areas, the stimulus from oil production has simply enhanced

an already healthy economy. The slowdown resulting from the

drop in oil prices should not result in large scale, metro-wide job

losses, but rather should impact clusters of oil-dependent jobs.

Local apartment markets, many of which were already poised for

a rise in vacancy and an easing of rent growth, will likely see some

additional softening, but this is not expected to be a significantly

negative event for the nation’s multifamily sector.

Opinions, analyses, estimates, forecasts and other views of Fannie Mae’s

Multifamily Economics and Market Research Group (MRG) included in these

materials should not be construed as indicating Fannie Mae’s business prospects

or expected results, are based on a number of assumptions, and are subject to

change without notice. How this information affects Fannie Mae will depend on

many factors. Although the MRG bases its opinions, analyses, estimates, forecasts

and other views on information it considers reliable, it does not guarantee that

the information provided in these materials is accurate, current or suitable for any

particular purpose. Changes in the assumptions or the information underlying

these views could produce materially different results. The analyses, opinions,

estimates, forecasts and other views published by the MRG represent the views

of that group as of the date indicated and do not necessarily represent the

views of Fannie Mae or its management.

Lower Oil Prices and Multifamily — More Winners than Losers