CRE Finance World Summer 2015

46

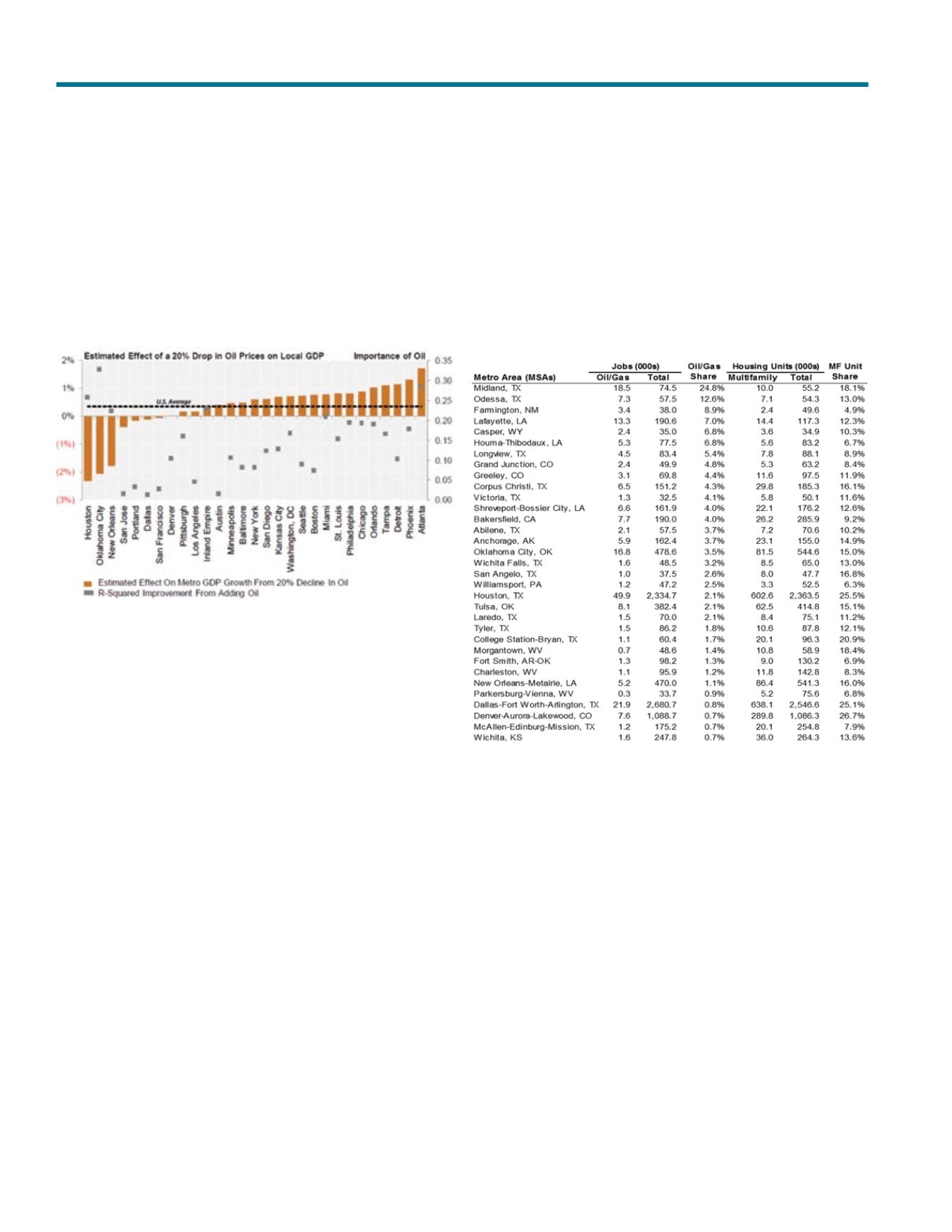

Exhibit 2

Estimated Change in Local GDP Due to Lower Oil Prices

Source: CoStar; R-Squared reflects the magnitude of the importance of oil in a metro’s economy

Potential Losers from Low Oil Prices

Among major U.S. cities, Houston has the most to lose from lower

oil prices and is the only primary metro in the U.S. that is expected

to be negatively impacted in a meaningful way. As the energy

capital of North America, its economy will be hit with the most

direct impact of the shock. Fortunately, that hit should not be

devastating since Houston has diversified its local economy in very

important ways since the oil bust a few decades ago, which should

end up blunting the anticipated drag on overall job growth.

There are several smaller metros that may not be so lucky and

are expected to encounter significant economic turbulence and

out-right job losses. These metros include Williston, North Dakota,

Oklahoma City, and Midland-Odessa, Texas, which have been

among the fastest growing metros in the country over the past

several years, as they have been riding the wave of growth related

to new oil well drilling. In addition, New Orleans will likely be

negatively impacted, albeit to a lesser extent.

As seen in the table below, there are several metros with nominally

large but proportionally small oil industry operations, like Williamsport,

PA, Denver, and Dallas, that could see a negative impact on their

local economies. However, the positive aspects of low oil prices,

like enhanced consumer spending and marginal expansion of

manufacturing due to lower energy costs, is expected to balance

out any negatives in these metros.

Exhibit 3

Oil/Gas Industry Employment (Including Support Businesses) and

Multifamily Housing

Source: Fannie Mae Economics & Mortgage Market Analysis, Moody’s Analytics, ACS; counts as

of 2012.

Not Much Multifamily in Impacted Metros

While housing may be in for a period of decline in fundamentals

in certain metros with a disproportionate dependence on oil

extraction, in truth, few of these metros have any significant

concentration of multifamily housing. Nationally, approximately

18 percent of housing units are in multifamily structures. As seen

in the table above, of the 33 metros listed that have a higher-than-

average concentration of jobs in the oil and gas industry, just six

metros have a concentration of multifamily housing exceeding

18 percent. And of those six metros, the only one with both an

unusually high concentration of oil and gas jobs (24.8 percent) as

well as a high concentration of multifamily housing (18.1 percent)

is Midland, Texas.

What’s Ahead for Houston?

Houston is headed for a slowdown, no doubt about it. However,

there is little agreement about the severity of the slowdown.

Fortunately, none of the major macroeconomic and commercial

real estate data providers expect the Houston economy to fall into

Lower Oil Prices and Multifamily — More Winners than Losers