A publication of

Summer issue 2015 sponsored by

A publication of

Summer issue 2015 sponsored by

CRE Finance World Summer 2015

13

The markets projected to lead office-using jobs over the next

five years are Phoenix-Mesa-Glendale AZ: 3.5%, Austin-Round

Rock-San Marcos TX: 3.5%, West Palm Beach-Boca Raton-

Boynton Beach FL: 3.3%, Raleigh-Cary NC: 3.1%, Dallas-Fort

Worth-Arlington TX: 3.1%, Miami-Miami Beach-Kendall FL: 3.1%,

Atlanta-Sandy Springs-Marietta GA:3.1%, Charlotte-Gastonia-

Rock Hill NC-SC: 3.0%, and Nashville-Davidson-Murfreesboro-

Franklin TN: 3.0%.

Projected OUJ growth is not by itself an indicator of the long term

vibrancy of an office market. For example, high projected job

growth may be indicative of a market rebounding from significant

great recession and housing bust job losses. These markets

may also be fundamentally volatile. Other growth markets may

be concentrated in a volatile industry such as energy. Growth

markets with very low educational attainment rates may not inspire

confidence in long term stability. If we separate out the energy

markets, markets rebounding from significant job losses, markets

with low education attainment rates, and major markets, the list

favors Austin-Round Rock-San Marcos TX, Greater Miami-South-

east Florida

18

, Raleigh-Cary NC, Dallas-Fort Worth-Arlington TX,

Atlanta-Sandy Springs-Marietta GA, Charlotte-Gastonia-Rock Hill

NC-SC, Nashville-Davidson-Murfreesboro-Franklin TN, Salt Lake

City UT, and Indianapolis-Carmel IN.

Housing Affordability And Young Families

Housing affordability is important for employers since wages

can be lower and young families can purchase homes for less.

According to Jed Kolko, chief economist at the online real estate

firm Trulia “Cities with the strongest job markets would grow even

faster if more people could afford to live there. The additional

population would help spur further job growth, which, in turn, would

strengthen the local economy and foster more middle-class jobs”

19

.

Housing affordability is a significant draw for YCEs as well as

young families with children aged 5-14. This age range is important

because it encompasses when parents often move due to the cost

of housing, schools and long-term economic security

20

.

Domestic migration is increasingly driven by the quest for affordable

housing. The country’s fastest-growing cities are now those where

housing is more affordable than average

21

.

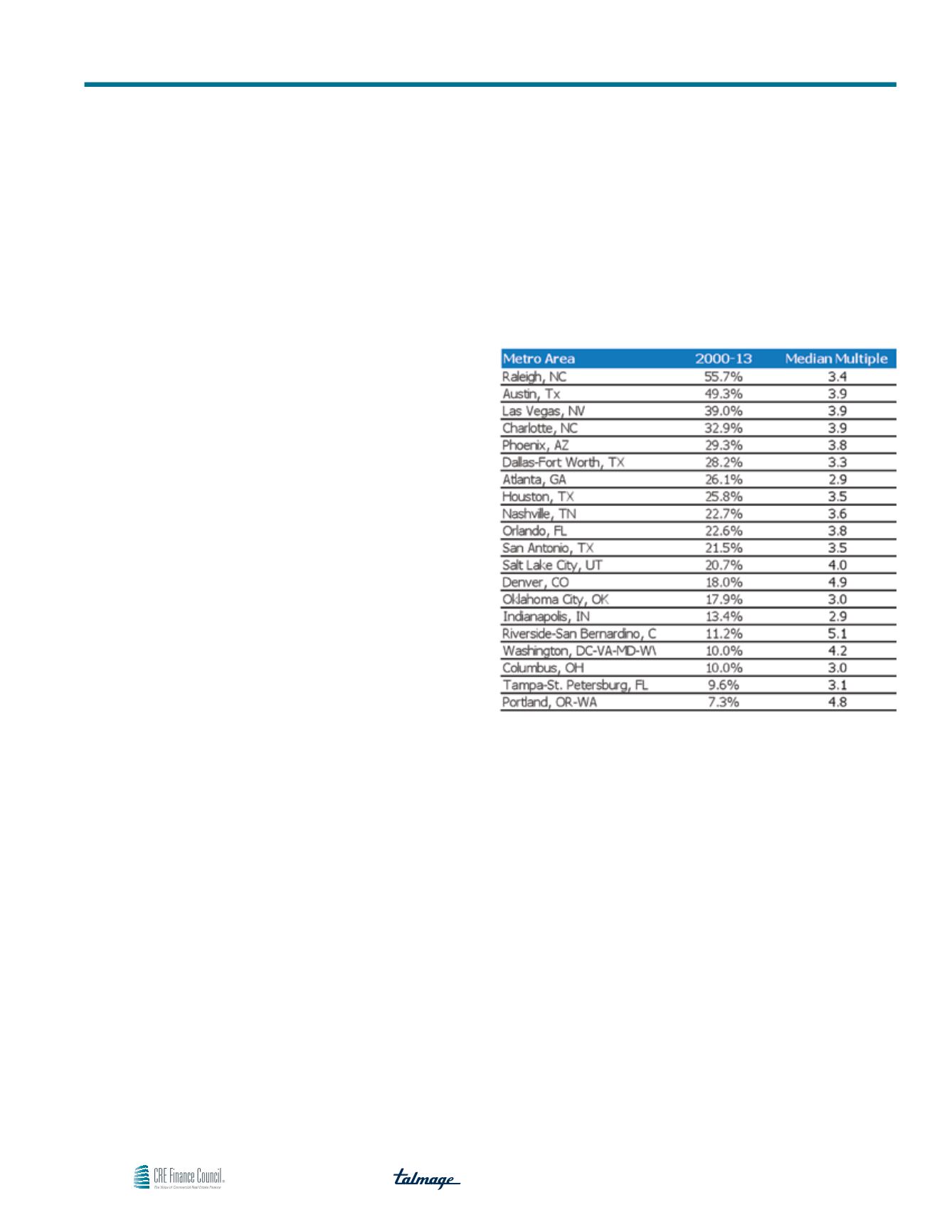

Table 4 presents metros that in fact have a growing population of

young families as evidenced by the number of children between

five and fourteen. The top 12 markets attracting young families

with children have housing affordability indexes of 4.0 or less.

Table 4

Rise in Number of Children Aged 5–14

Source: Joel Kotkin and Wendell Cox for rise in number of children and Wendell Cox and Hugh

Pavletich, “11th Annual Demographia International Housing Affordability Survey” (2015 Edition:

Data from Third Quarter 2014) for housing affordability

The above chart lists metros attracting families with young children.

It includes markets with high growth in YCE, OUJ, and with relative

affordable housing such as Raleigh, Austin, Charlotte, Dallas,

Houston, and Nashville. The combination of affordable housing

and economic growth attract young families, which in turn fosters

further growth.

22

Conclusion

The metros that seem poised for long-term growth based on the

criteria detailed in this report are Austin, Raleigh, Denver, Salt Lake

City, Nashville, and Charlotte. These markets exhibit fundamental

strength in high and/or growing education attainment levels. They

have experienced a relatively high rate of growth in the number

of college graduates aged 25 to 34, from 2000 to 2012. They

have experienced growth and/or forecast to experience growth

in office-using jobs. Housing is relatively affordable and young

families have migrated to these metros. Most of the aforementioned

metros have growing tech sectors. These office markets stand

out in several long term growth factor categories that create and

sustain office demand.

Beyond The Big Six: Identifying Alternative Us Office Markets Based On Long Term Demand Generators