CRE Finance World Summer 2015

10

U

Beyond the Big Six: Identifying Alternative US Office Markets Based on Long Term Demand GeneratorsStewart Rubin

Director

New York Life Real

Estate Investors

S office building sale prices are 3.5% above the November

2007 peak of the last cycle (107.6% Percentage Peak-

to-Trough Loss Recovered)

1

. Much of the value increase

is associated with major market Central Business District

(CBD) office space in Boston, Chicago, Los Angeles,

New York, San Francisco, and Washington. The Office-CBD Major

Market Index is 27.5% above its previous peak (155.9% Percentage

Peak-to-Trough Loss Recovered). The six major markets have

experienced significant foreign and domestic investment. These

markets mostly benefit from long term growth factors including high

education attainment levels, high share of residents with Science,

Technology, Engineering, and Math (STEM) degrees, significant

high-tech location quotients (LQ), lack of exposure to the more

volatile energy sector, and high current office employment.

Boston, Chicago, Los Angeles, New York, San Francisco, and

Washington are global cities with strong economic engines.

However, since these major markets are priced well beyond

previous peak levels, alternatives will be identified. The alternative

investment markets either have or are acquiring some of the

underlying characteristics of the big six markets. Although they

may never achieve the depth and status of the big six markets,

they have long term value growth potential. Many of these metros

are being transformed and will likely be larger and stronger office

markets in 15 to 20 years time.

The metros that seem poised for long-term growth based on the

criteria detailed in this report are Austin, Raleigh, Denver, Salt Lake

City, Nashville, and Charlotte. These markets excel in several long

term growth factors that spawn and sustain office demand. These

demand factors include the aforementioned education and high-

tech emphasis, but also include characteristics that are attractive

to corporations and young college graduates such as affordable

housing. Other markets such as Seattle, San Diego, Atlanta, Dallas-Ft. Worth, Portland, Minneapolis, and Indianapolis exhibit long term

growth attributes in certain categories that suggest consideration

after factoring qualitative factors and overall market position. The

markets are selected from a long term investment perspective

independent of short term supply considerations. Focus is placed

on secular change underlying cyclical rhythms.

Major Markets

The major markets of Boston, Chicago, Los Angeles, New York,

San Francisco, and Washington, DC are driving high office building

values. Aside from the availability of low cost capital, major market

CBD office benefitted from foreign investment. US Gateway cities

have attracted investors pursuing stable investments and, in addition

in the case of foreign capital, the quest for safety. Additionally,

Houston had recently been a magnet for investment; however, high

energy prices fueled demand, which might quickly evaporate if the

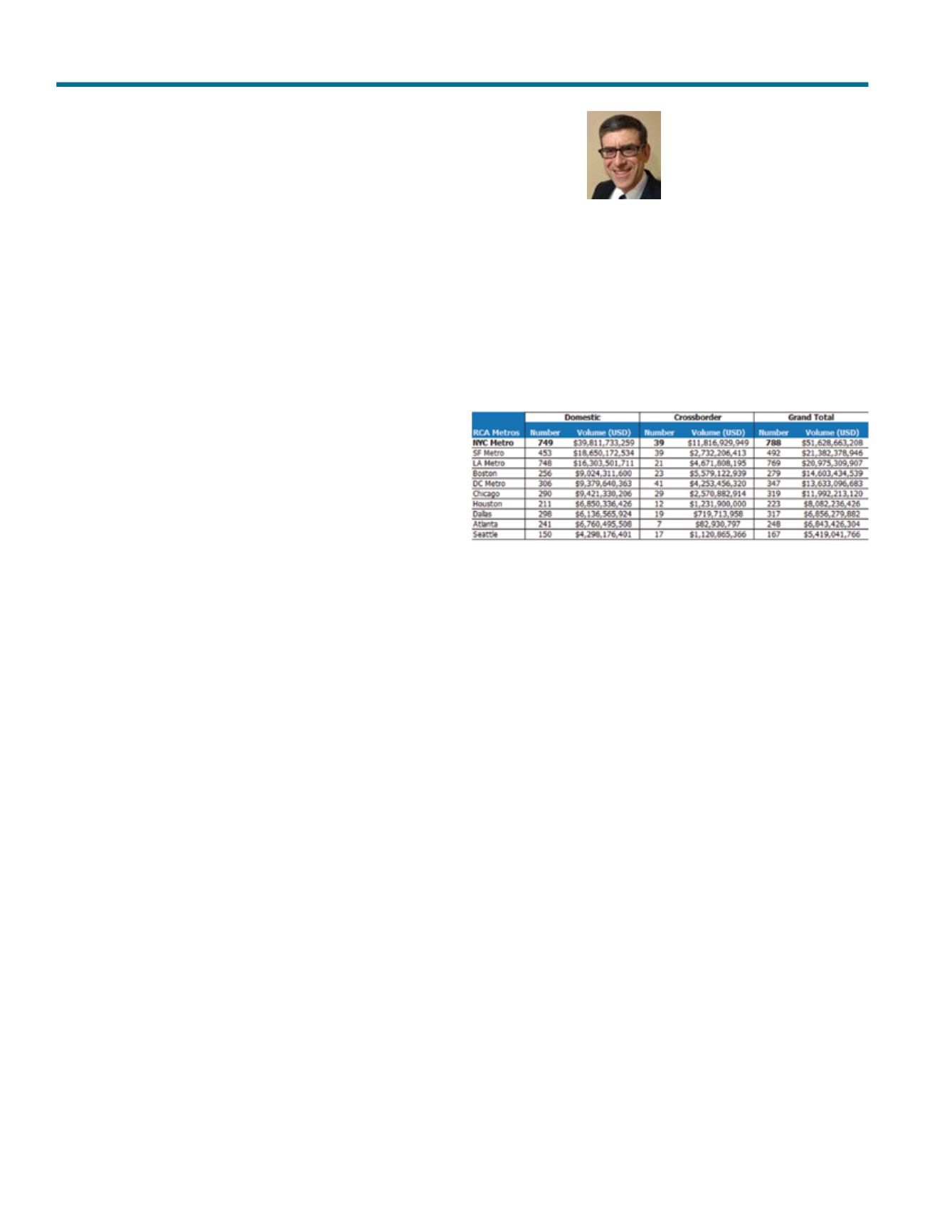

recent decline in energy prices persists. Table 1 details the top

metro areas for foreign and domestic investment in office buildings.

Table 1

Top 10 Metros Office Total Volume

Past 24 Months YE November 2014

© Real Capital Analytics, Inc. 2014

Market values in major markets have soared despite lagging market

fundamentals. With the exception of San Francisco, real office

rents in major markets are between 11.1% and 22.0% below their

previous peak. Overall, record office building values notwithstanding,

underlying real estate fundamentals have not recovered back to

peak levels experienced before the last recession. In order to invest

prudently it is important to identify long-term secular trends that

underlay the broader real estate cycle being experienced.

Factors for Evaluating Long-Term Trends in Metro Areas

College educated people tend to self-sort into metro areas in

which there are opportunities. In turn companies locate in places

where they can hire educated employees. This circle of opportunity

becomes self-perpetuating as jobs are created in these metros.

Accordingly, metros with high education attainment rates are favored.

We also examined and prioritized markets in which young college

educated persons

2

(YCE) live and are relocating to. Similarly markets

with a high degree of STEM graduates attract employment growth.

Technology jobs have a disproportionate impact on local economies.

Markets with tech job growth and high location quotients in tech

using office jobs are identified.

The primary manifestation of office demand is office-using jobs

(OUJ). Markets in which office-using jobs have grown over the

past five years and are projected to grow over the next five years

will be highlighted later in this report. Young workers are attracted

to metro areas with job opportunities and affordable housing.

Metro areas with affordable housing include some of the highest

population growth markets in the nation. Markets with high growth

in the number of children between the ages of 5 and 14 are noted

later in this report. In addition to these children representing future

demographic growth, the parents of this age group have usually

set down roots at this point

3

, establishing a demographic base.