A publication of

Summer issue 2015 sponsored by

A publication of

Summer issue 2015 sponsored by

CRE Finance World Summer 2015

59

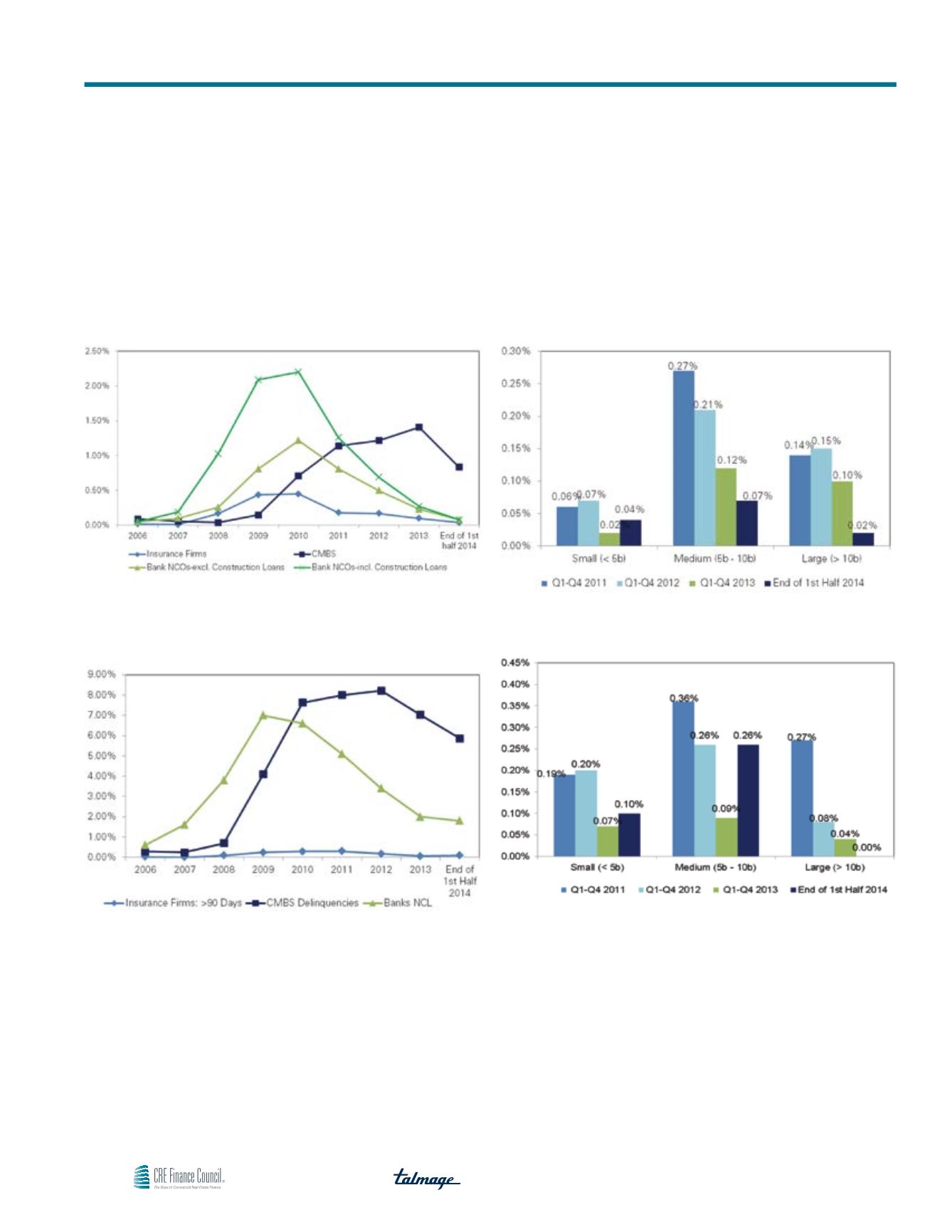

Exhibit 2

Total Realized Net Losses

Source: Bank Losses & DQs — Trepp Bank Navigator

CMBS Losses & DQs — TreppCMBS

Exhibit 3

Delinquencies 90+ Days

Source: Bank Losses & DQs — Trepp Bank Navigator

CMBS Losses & DQs — TreppCMBS

Looking across the spectrum of firm sizes, the losses recorded in

the first half of 2014 for Large and Medium firms were much lower

than year-end 2013 figures. Small firm losses, on the other hand,

increased slightly. Larger firms tend to take their losses early,

while cumulative losses for small firms have stayed low and have

been more evenly distributed over time. For delinquencies of 90+

days, both Small and Medium firms reported higher delinquencies

at mid-year 2014 than at year-end 2013. Large firms reported no

90+ day delinquencies as of mid-year 2014.

Exhibit 4

Total Realized Net Losses by Firm Size

Exhibit 5

Delinquencies (90+ Days) by Firm Size

Permanent First mortgage loan losses represented 83.54% of the

total losses reported at mid-year 2014, which is a slight decline

from year-end 2013. Subordinate debt losses increased 7.5%

to 16.46%. No losses were reported for Construction loans.

Subordinate debt had the highest loss severity of approximately

51% as of mid-year 2014—a clear reminder of the volatility of

subordinate debt and the weaker position of junior lien holders

versus first lien holders.

Portfolio Lenders Survey: U.S. Life Insurers’ Mortgage Outlook