Forum Spotlight: GSE/Multifamily Lenders

November 5, 2024

Ahmed Hasan (Forum Chair), David Haynes (Chair-Elect), and Kate Whalen (Past Chair), as well as Jason Griest and Alonzo White (both GSE representatives), form the “Leadership Working Group” of CREFC’s GSE/Multifamily Lenders Forum. This group sets agendas and priorities for the Forum and represents their constituencies on CREFC’s Policy Committee.

Key GSE/Multifamily Lenders Focus Areas:

- Sustained elevated interest-rate environment and the uncertainty of how quickly, or if, long-term interest rates will change

- Investor appetite for increased agency issuances

- Upcoming presidential election and 2025 FHA scorecard/updates that may impact 2025 business

What They Are Saying: The GSE multifamily sector continues to stand out as an area of strong credit despite the challenges of a sustained high-rate environment and the impact inflation has had on property performance.

The GSEs have seen a significant increase in multifamily mortgage originations in the second half of 2024. The uptick is driven by:

- A decrease in U.S. Treasury rates and

- Increased investment sales activity.

Despite the current volatility in economic data and benchmark rates, there is optimism that the momentum will continue and the market expand in 2025.

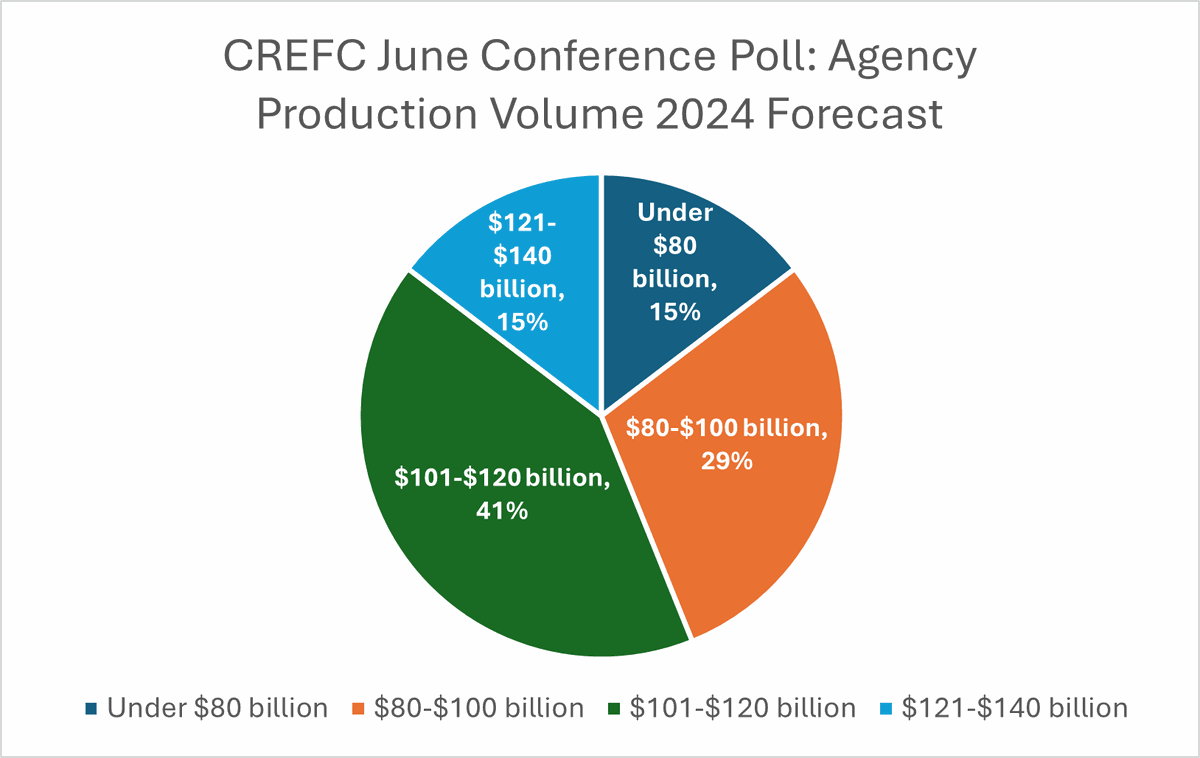

By the Numbers: CREFC polled the audience at its June 2024 annual conference and found that 56% of participants expected GSE multifamily issuance to end 2024 north of $100 billion. Today, that expectation likely will come to fruition, thanks to a significant increase in originations spurred on by a sharp third-quarter decrease in U.S. Treasury rates.

Key Forum Policy Issue: Tenant Protections

In July 2024, FHFA issued a new policy for multifamily properties financed by the GSEs to include a minimum of a:

- 30-day notice of a rent increase

- 30-day notice of a lease expiration

- Five-day grace period for late rent payments

These standards will go into effect for all new loans on or after February 20, 2025.

What’s Next: CREFC’s DC Symposium on Nov. 13 will feature a conversation between Freddie Mac CEO Diana Reid and Bob Foley, Partner, TPG Real Estate and Chief Financial Officer, TPG RE Finance Trust, Inc. Mr. Foley is also the acting Chair of CREFC’s Board of Governors. Symposium attendees are sure to be keenly interested in the housing agency CEO’s perspectives on key issues impacting the industry and how Freddie Mac provides liquidity, stability, and affordability for housing in communities nationwide.

GSE Forum leaders look forward to presenting CREFC members with an update on their forum at CREFC’s January Conference in Miami, to be held from January 12-15, 2025.

As June 2025 approaches, the chairs will seek nominations for the next Chair Elect to join their leadership slate. To join the GSE/Multifamily Lenders Forum, please register here.

Please contact Rohit Narayanan (RNarayanan@crefc.org) with any questions