2024 Presidential Polling Reveals Shifts in Swing States

May 14, 2024

There have been some noticeable shifts in polling for the 2024 presidential election over the last two months. This week, we analyze recent polls for swing states as well as some “stretch” states both campaigns are eager to win.

What’s Happening: Swing State Swings

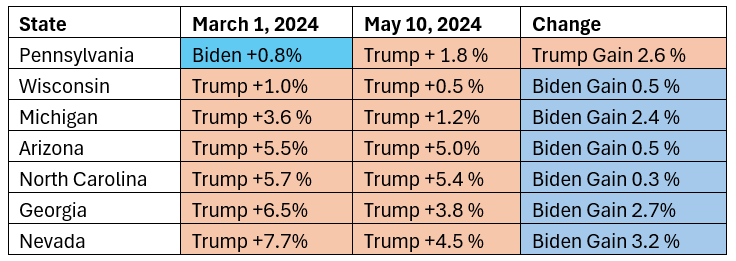

The “swing-state” chart below provides snapshot of where the race stood in key states on March 1, prior to the president’s State of the Union address and the Stormy Daniels hush money trial in New York, and where it stands on May 10.

Note: The impact of the trial on polling is yet to be fully realized.

Source: https://www.realclearpolling.com/

Go Deeper: In every state except Pennsylvania, former President Donald Trump has lost ground since March 1. The three states where Trump appears to have lost the most ground are Nevada, Georgia, and Michigan. Despite these shifts, Trump still leads the polls in these states, while North Carolina remains hotly contested.

- Nevada: Democratic presidential candidates have carried Nevada since 2008. Other than in 2016, the state has voted for the winning candidate since 1980. While Democrats won with a 2.4% margin in the previous two cycles, that margin was not as close as it was in some other swing states. If President Biden is in trouble here on election day, it will likely be a big night for Republicans.

- Georgia: President Biden won Georgia by 11,779 votes. If Trump can flip this state back to his column in 2024, its 16 electoral college votes will offer him multiple paths to winning back the White House.

- Michigan: Michigan has voted with the winner of the presidential election since 2008. Among the historical “Blue Wall States” of Pennsylvania, Michigan, and Wisconsin, Biden has performed best in Michigan with a 2.8% margin of victory. Biden was ahead of Trump in the polls by about 1% in Michigan until last October when Trump overtook him just as the Israel-Hamas war started.

- The Blue Wall States are all within the standard 3% margin of error when it comes to polling results. If Trump’s strength is overstated by the polls, then a Biden win becomes more likely even if Trump carries the other four swing states.

- North Carolina While viewed as always just out of reach for the Democrats, North Carolina is the most likely to flip out of any on the list above. President Obama last won it in 2008, but it has since been reliably, though narrowly, Republican. Yet, the sub-4% margins give Democrats hope at the possibility of flipping its 16 electoral votes.

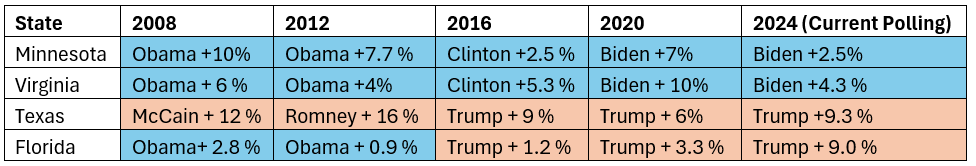

Expanding the Map

In every cycle, there is inevitably a period in which campaigns talk about expanding the map to new swing states and, typically, the press follows suit as is the case here in a recent article from Roll Call.

The four states below have been on each party’s radar to flip for a few election cycles, as polling sometimes demonstrates unexpected campaign strength or weakness. Former President Trump is currently polling about 4% to 6% ahead of the vote count he received in 2020 in each of these states.

- Minnesota: In the leadup to the 2020 election, Trump targeted Minnesota as a swing state due to Clinton’s narrow 2.5% victory. However, it landed squarely back in the blue column with Biden winning it by 7% in 2020. Recent polling may keep it in the news cycle, but don’t expect Minnesota to flip. The state has voted Democratic every presidential election since 1976.

- Virginia: A previous GOP stronghold, Virginia has been reliably Democratic since 2008. With the Blue counties in Northern Virginia trending even more Democratic, a flip here is more difficult but would likely usher in President Trump. Biden won the state by a commanding 10%, compared to Clinton’s 5.3%.

- Texas: Over the past decade, Texas voters have been steadily trending towards Democrats, but it has remained out of reach enough to be branded a battleground state. However, the vote margin here will be closely watched for 2028 and beyond, due to its growing population and whopping 40 electoral votes.

- Florida: The once perennial swing state famously decided the 2000 election and has voted with the winner of the election in every cycle since 1976 except in 1992 and 2020. Florida’s rightward shift was well demonstrated in 2022, and it is the only battleground state where Trump improved his vote share from 2016. If this state flips, a second term for Biden would be a near guarantee. With abortion access on the ballot, Democrats may see a pick-up opportunity, but a flip here is unlikely.

Yes, but: The election will likely come down to the seven expected swing states mentioned in the first chart, but the four “stretch" states will play a key role.

The Bottom Line: Biden’s poor standing in the South and Sunbelt states cannot be understated. If he doesn’t improve in Nevada, Arizona, Georgia, and North Carolina, and Trump sweeps all of them. Biden will have to hold on to Pennsylvania, Michigan, and Wisconsin to have any chance to secure a second term.

Contact James Montfort (Jmonfort@crefc.org) with any questions.The information provided herein is general in nature and for educational purposes only. CRE Finance Council makes no representations as to the accuracy, completeness, timeliness, validity, usefulness, or suitability of the information provided. The information should not be relied upon or interpreted as legal, financial, tax, accounting, investment, commercial or other advice, and CRE Finance Council disclaims all liability for any such reliance. © 2023 CRE Finance Council. All rights reserved.